“Save the planet.”

“Do it for future generations.”

“Because it’s the right thing to do.”

We’ve been making emotional appeals to companies for decades. And yet emissions continue to rise, biodiversity collapses, and sustainability still sits at the edge of most business decisions.

The problem isn’t that companies don’t care.

It’s that caring is not a business strategy.

CEOs report to boards. Investors expect returns. EBITDA and profitability remain the measures of success.

But what if carbon reporting wasn’t about being green, but about making smarter, more resilient business decisions?

What if it became a way to surface operational inefficiencies, understand supplier exposure, and make more informed decisions about where to invest, cut, or change course?

That shift is no longer theoretical.

Under the EU’s new CSRD regulations, professional services firm Grant Thornton estimates that nearly 50,000 new companies will soon be required to disclose sustainability data (Article) — not as a values statement, but as regulated input into financial risk, capital allocation, and corporate resilience.

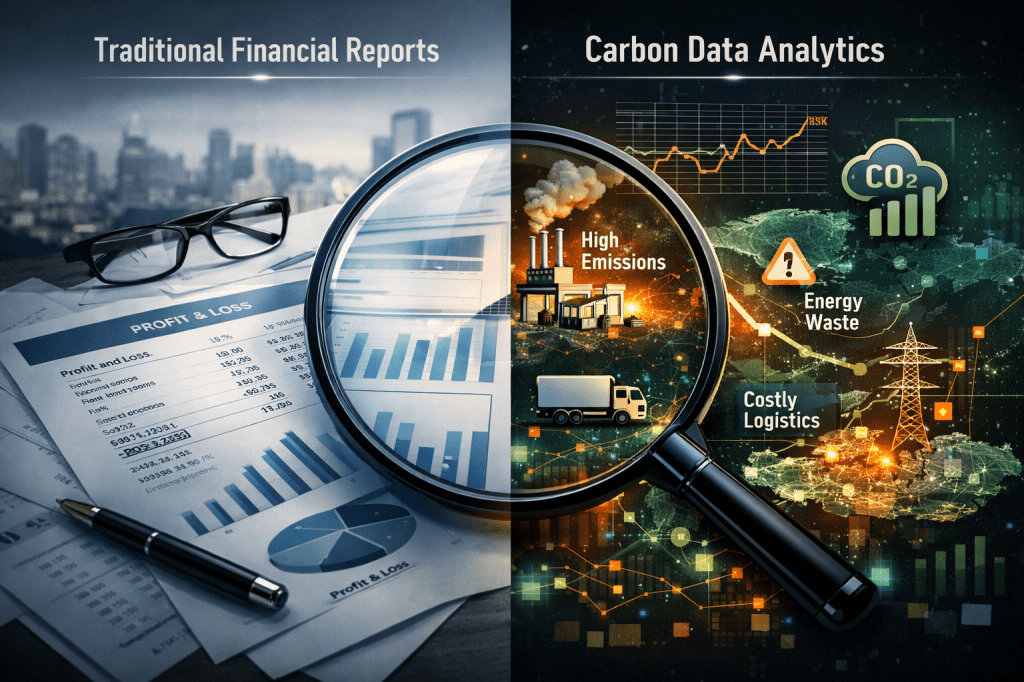

The reality is that carbon data exposes inefficiencies traditional financial reports often miss, such as energy spikes by site, logistics routes with disproportionate emissions, or suppliers creating hidden exposure. An article by CDP cites that “Corporates reported that …scope 3 emissions were on average 26 times higher than their operational emissions” (Article). The cost already exists; it’s simply fragmented across systems and rarely consolidated into a single decision-making view.

With proper carbon reporting, businesses gain visibility into where tomorrow’s costs are likely to land, and more importantly, how to reduce them. Sustainability begins to shift from an ideology to informed investment. Instead of “we have to reduce emissions,” the question becomes: which initiative reduces cost, risk, and exposure fastest?

Ironically, the biggest current costs to businesses isn’t the reporting itself — it’s failing under scrutiny. EU CSRD impact estimates and investor surveys suggest that companies spend far more on hunting down, validating and correcting ESG data than filing it. (Article)

CSRD reporting is audited. Data must be consistent year-on-year. Assumptions must be defensible. Penalties tied to national reporting laws can reach up to 5 % of a company’s annual turnover for serious non-compliance, as seen in jurisdictions such as Germany.(Article) And while CSRD itself doesn’t directly impose personal liability, national laws implementing its requirements can expose directors to personal fines of up to 75,000EUR or sanctions if they fail in their oversight duties.(Article)

But for companies willing to shift their mindset, carbon reporting can become something else entirely: a competitive edge. In a rapidly changing regulatory and economic landscape it allows businesses to adjust procurement strategies, prioritise investment, and reduce exposure ahead of competitors who are still reacting to last year’s numbers. The European Central Bank and major asset managers such as BlackRock(Article) have confirmed that sustainability data quality now feeds directly into credit risk and investment decisions. Poor or unreliable carbon data doesn’t just create reporting risk, it can increase the cost of capital.

With that in mind, businesses that treat carbon reporting as operational and financial intelligence don’t just comply faster. They operate with lower friction, better visibility, and more strategic flexibility than those forced to catch up later.

In my humble opinion, the companies best prepared won’t be the ones with the loudest promises, They’ll be the ones who manage their carbon data with precision & strategic intent.

Leave a comment